Labour Market Report 2022

The Labour Market report provides an assessment of West Yorkshire’s skills needs based on a detailed analysis of the supply and demand of skills in the area. It examines the strengths and weaknesses of the local labour market, including structural factors which may continue to impact the region in the future.

The information outlined in the report is designed to inform local policy development, as well as curriculum strategies of local institutions. Organisations are encouraged to use the data provided to plan recruitment and training strategies, whilst educational practitioners may find the data useful in advising young people in their career plans.

Users may browse all sections of the report by scrolling, or jump directly to sections of interest using the navigation bar at the top of the page. Resource packs relating to key sections are available to download.

This online resource highlights the key information in the 2022 Labour Market Report. Click below for the full report.

Devolution

The Election of the West Yorkshire Mayor, Tracy Brabin, provides an unprecedented opportunity to make progress on employment and skills issues as part of a devolved approach to transforming the regional economy. It gives local control of at least £1.8 billion of funding to be spent on the things that make a difference to the people of West Yorkshire, including substantial funding for adult education.

We can use our understanding of regional needs to inform decision-making and the development of tailored employment and skills solutions. The devolution deal includes responsibility for the £65m Adult Education Budget (AEB), to fund training programmes for West Yorkshire residents aged 19+, providing them with the skills needed for entering and sustaining work, an apprenticeship / traineeship, or other further learning.

Several of the Mayor’s pledges directly address employment and skills issues, whilst most others have an employment and skills dimension.

10 Pledges to West Yorkshire:

Create 1,000 well paid, skilled jobs for young people.

Prioritise skills and training to ensure everyone in West Yorkshire has the skills they need to secure work.

Support local businesses and be champion for our regional economy.

Lead a Creative New Deal to ensure our creative industries are part of the broader recovery strategy.

Appoint an Inclusivity Champion to work to ensure that the region’s recovery benefits us all.

Recruit 750 more frontline police officers and staff to fight crime.

Put women and girls’ safety at the heart of my policing plan.

Bring buses back under public control, introduce simpler fares, contactless ticketing and greener buses.

Build 5,000 sustainable homes including council houses and affordable homes.

Tackle the climate emergency and protect our environment.

West Yorkshire is a vibrant, internationally-significant economy, with a population of over 2.3 million, output of £58bn, 95,000 private sector businesses and an employed workforce of 1.1m.

Productivity

West Yorkshire’s position on skills has a direct impact on its performance on productivity, pay and employment and hence on the overall level of prosperity in the area.

West Yorkshire under-performs on productivity.

Increased productivity is the main contributor to growth in the wider economy and provides the foundation for improvements in living standards.

Output per hour worked in West Yorkshire fell from 88% of the England average in 2007 to 85% in 2019, indicating that local productivity growth has lagged the rate of growth seen nationally and the gap in productivity performance has widened.

All local authorities in West Yorkshire have a level of productivity that is below the West Yorkshire average, except Leeds; its output per hour of £33.26 is still only 94% of the national average.

Pay

Productivity is closely linked to pay and therefore to living standards: more productive firms pay higher wages.

Local pay is below the national average.

The local productivity deficit is reflected in the pay situation. Median gross weekly pay for full-time jobs in West Yorkshire is £565, 92% of the England average. At local authority level this varies between £528 in Kirklees (86% of the national average) to £595 in Leeds (97% of the national average).

A significant proportion of jobs in West Yorkshire pay below the Real Living Wage.

Eighteen percent of local jobs, almost 170,000 in absolute terms, pay less than the Living Wage Foundation’s Living Wage rate, which is intended to reflect the level of pay people need to get by. In Kirklees, 22% of jobs fall below the Living Wage threshold, the biggest proportion in West Yorkshire.

What’s driving the reduction in low pay against this measure? It coincides with recent increases in the National Minimum Wage (NMW) and National Living Wage (NLW) rates. The improvement also coincides with the additional increase in the NMW for those aged 23 and 24 years, who join those aged 25 years and over in receiving the NLW in 2021.

West Yorkshire’s gender pay gap is the same as the England average.

West Yorkshire faces a significant gender pay gap. The overall pay gap for all employee jobs locally is 16%, the same as the national average. The size of this gap partly reflects the fact that women are more likely than men to work in part-time roles which attract a lower hourly rate of pay. However, at 10% the gap for full-time jobs is smaller but still substantial, and slightly above the national average.

The gender pay gap for all jobs is highest in Calderdale and Kirklees at 18% and lowest in Wakefield at 14%. Bradford is the same as the West Yorkshire and national average and Leeds slightly below at 15%.

Bradford, Leeds and Wakefield have negative gender pay gaps for part-time workers. This shows that male part-time workers in these local authorities are low-paid relative to their female counterparts.

The highest paid jobs in the region are paid significantly less than the highest paid jobs nationally and this is the main source of the overall pay gap. This, in turn, reflects the under-representation of jobs in the highest skilled and highest paid occupations in the region.

Deprivation

Skills deficits play a part in neighbourhood-level deprivation.

According to the English indices of deprivation 2019 , 22% of neighbourhoods in West Yorkshire are among the 10% most deprived nationally, more than twice the share one would expect. There are 302 acutely deprived neighbourhoods in West Yorkshire that fall into this category.

Skills deprivation relating to adults is a key issue for West Yorkshire.

Across West Yorkshire a greater proportion of neighbourhoods (23% of the total) face acute deprivation in respect of adult skills rather than relating to children and young people (17%), although the latter is still relatively high. There are also differences at district level.

Unemployment

Getting people into work is central to inclusive growth and boosting individual living standards. At the current time, unemployment remains well above pre-pandemic levels (in claimant count terms) even though the worst-case scenario of mass unemployment was not realised during the lockdown of the economy.

West Yorkshire’s unemployment rate is currently slightly above the national average, based on the ILO measure.

According to the Annual Population Survey for July 2021 to June 2022, the official measure of unemployment in West Yorkshire stands at 48,000, 4.2% of the population aged 16-64. This is slightly above the national average of 3.9%.

In addition to the 59,000 people who are unemployed, and who are available for and actively seeking work, consideration needs to be given to people who are economically inactive but who would like a job. According to the Annual Population Survey estimate for October 2020 to September 2021, there were 47,000 people of working age falling into this category in West Yorkshire, around 14% of all economically inactive people in this age group.

This section provides an overview of the demand for skills in the West Yorkshire economy, based on the profile of jobs locally and the skills required to do those jobs. It considers the current picture and the way in which the pattern of demand is expected to develop in the future.

Employment rate

The level of employment is the main indicator of the overall demand for labour in the area, although it is difficult to measure the impact of COVID-19 and the subsequent recovery on employment in a timely manner in local economies using official data.

West Yorkshire’s employment rate was negatively affected by the pandemic.

There are 1,072,000 people in employment in West Yorkshire based on data for the July 2021 to June 2022 period.

The employment rate in West Yorkshire, expressed as a proportion of the population aged 16-64, is slightly below the national average at 74% (versus 76%). An additional 28,000 people would be in employment in West Yorkshire if the employment rate could be raised to the national average.

The local rate has been consistently lower than the England average over the last 15 years and along with the national average has followed an upward trend since 2012, reflecting the progress of the recovery from the global financial crisis. Between 2013/14 and 2021/22 the level of employment increased by 9% in West Yorkshire, a similar rate of growth as seen nationally.

Employee jobs and full-time employment have been key contributors to employment growth in the local area in recent years.

In overall terms West Yorkshire has seen an upward trend in employment in recent years,; but there is also the question of the nature of the jobs created through that growth. There is a widespread concern about the quality of jobs and in particular the rise of “atypical” forms of employment, including self-employment, part-time employment, temporary employment and zero hours contracts.

West Yorkshire’s current employment profile by status is similar to the national average. The key differences are that workers are more likely to be employees and working full-time.

Sectoral employment profile

The sectoral make-up of a local area is an important determinant of the workforce skills that are required. Sectors have distinctive occupational employment structures with implications for skill requirements.

Among the largest sectors by employment are health and social care and manufacturing.

Health and social care (141,000 jobs; 13%); and Manufacturing (105,000; 10%); together with Business administration and support services (110,000; 10%).

In addition to Health and social care there is also significant further employment in activities that are primarily public sector-based, including Education (100,000; 9%) and Public administration and defence (44,000; 4%).

In respect of business-related services, professional services activities account for employment of 84,000.

Finance and Information and communication are much smaller contributors to employment, with 4% and 3% of total employee jobs respectively – they are modest in relative terms but still substantial areas, with employment of 44,000 and 33,000 respectively.

Overall, there are 202,000 public sector employee jobs in West Yorkshire.

West Yorkshire has key specialisms in manufacturing and financial services.

Manufacturing is strongly represented in West Yorkshire. In proportionate terms, it is around a third larger than nationally. Manufacturing specialisms in West Yorkshire which are also significant in absolute terms include, the manufacture of food, textiles, chemicals, fabricated metal products, machinery and furniture.

Patterns of sectoral employment change

The pattern of growth and decline across industry sectors is a key driver of change in terms of skills requirements.

Service activities have been the main sources of recent sectoral employment growth but manufacturing and construction also grew.

The business service categories of Administration and support services, Transportation and storage and Professional scientific and technical activities had the highest net employment growth followed by Health and Accommodation and food services. Looking beyond services, Construction also grew substantially over this period, as did Manufacturing, albeit only to a modest extent.

The latest national data indicates that some sectors have not fully recovered in employment terms following the pandemic.

At national level the number of workforce jobs fell by 3% during the early part of the pandemic, between December 2019 and December 2020. A wide range of sectors shared in the decline, including Accommodation and food service, Manufacturing, Construction, Wholesale and retail and Arts, entertainment and recreation. Some sectors grew, however, most notably Public administration and Health and social work.

Comparing the picture in December 2021 with December 2019, Manufacturing employment remains 6% below pre-pandemic levels (-134,000), Construction 5% below (-102,000), and Accommodation and food service 4% below (-76,000). Employment in Wholesale and retail continued to decline in this period and is 200,000 below its pre-COVID position.

Profile of occupational employment

How is employment in West Yorkshire distributed at a detailed occupational level? This gives an insight into the profile of work that people do locally and the skills needed to do that work.

Administrative, Elementary admin and service and Business and public service associate professional roles are the biggest occupations in West Yorkshire.

The five largest groups, each employing more than 80,000 people in West Yorkshire are:

- Administrative occupations, including book-keepers, payroll managers and admin roles in finance and local government, employing 103,000 people.

- Elementary administration and service roles (employing 93,000 people), a category which includes hospitality staff such as waiters / waitresses, bar staff and kitchen and catering assistants; cleaners; and elementary storage roles.

- Business and public service associate professionals (employing 90,000), a diverse category which includes sales and marketing, human resources, financial and public service roles at the associate professional level.

- Corporate managers (employment of 85,000), which comprises management roles from across different parts of the economy, including retail, production managers in manufacturing and construction, financial managers and marketing and sales managers.

- Caring personal services (employment of 84,000), which includes care workers and home carers, teaching assistants, nursing auxiliaries and nursery nurses

Overall, employment in higher skilled management, professional and associate professional occupations is under-represented in West Yorkshire. These occupations account for 48% of total employment compared with 50% nationally. In absolute terms this represents a deficit of 28,000 fewer people in higher skilled employment.

Patterns of change in occupational employment

Growth in employment is being driven by higher skilled occupations and but also by administrative and caring occupations.

The occupational area seeing the biggest growth in absolute terms (+23,000) and also the fastest rate of growth for this period (+51%) is Science, research, engineering and technology professionals. Growth has largely been driven by increased employment for digital professionals.

Business and public service associate professionals also saw substantial grow in both absolute (+16,000) and percentage terms (+20%).

Employment in Administrative roles grew during this period (+10,300; +13%).

Caring personal services continued its long-term upward trend in employment, with net growth of 10,000 or 12%. National data would suggest that Care workers and home carers plus Nursing auxiliaries and assistants made substantial contribution to this growth.

Elementary administration and service occupations experienced the biggest decline in employment over this period, falling by 8,000; although because of the large size of this category this equates to a fall of only 8%.

Employment in Sales occupations also fell by 8,000, a 12% rate of decline.

Employment in Secretarial roles fell by 6,000 or 24% over the period, the fastest percentage rate of decline of any occupation.

The occupations that saw the fastest rate of growth in percentage terms were, again, higher skilled: Culture, media and sports (+39%: +7,000), Science, engineering and technology associate professionals (+39%; +7,000) and Health professionals (+26%; +10,000).

Vacancies (online job postings)

Job vacancies provide a key insight into the level and nature of current labour demand and employer skills needs. At local level this means examining the types of job that are being advertised via online job postings and the skills that are being specified in those postings. This gives an insight into current recruitment levels and patterns and the timeliness of these data provide an insight into recent developments in a volatile labour market.

National data shows vacancies at record levels for most industries.

For context, we have also drawn on official data at national level from ONS’ vacancy survey This shows that vacancies in all sectors are well in excess of their pre-pandemic level, with particularly strong rates of growth seen in Accommodation and food service (+93%), Construction (+85%), Manufacturing (+81%) and Professional scientific and technical (+79%).

Accommodation and food service is the sector with by far the highest ratio of vacancies to employment, reflecting the intense recruitment demand in the sector following the re-opening of the economy.

Online job postings have grown strongly since the re-opening of the economy although the outlook is uncertain in view of the potential effects of the cost of living crisis and the war in Ukraine.

The level of recruitment activity in the local labour market was profoundly affected by the COVID-19 lockdown. However, the count of online job postings for job openings in West Yorkshire recovered to pre-pandemic levels by the autumn of 2020 and has grown since then, gathering momentum with the re-opening of the economy in summer 2021.

Some sectors increased their share of total postings during 2020-21 due to Covid-19. The most notable example is Health and social work, which faced intense demands on its capacity during this period. Other sectors, most obviously Accommodation and food service experienced a sharp decline in its share of postings in 2020-21 as much of its activities were restricted during prolonged lockdown periods. This was also the case for sectors such as Arts, entertainment and recreation and Retail.

Higher skilled occupations are ranked highest in terms of volume of postings.

The occupational profile of local job postings is broadly similar to the national average, although there are differences at local authority level.

Higher skilled management, professional and associate professional occupations account for a similar proportion of total postings in West Yorkshire compared with nationally, at a combined 57% versus 58%. In Leeds the proportion is above the national average at 63% but it falls to 51% in Bradford and only 40% in Calderdale, 48% in Kirklees and 47% in Wakefield. Almost two-thirds of postings for higher skilled jobs across the five local authorities relates to opportunities in Leeds.

Relative to the national average Leeds has strong demand for Corporate managers, Science, research, engineering and technology professionals (including digital professionals), Business, media and public service professionals and Business and public service associate professionals.

It is important to note that all 25 of the occupational categories enjoyed growth in absolute terms during the April to March 2021/22 period as the overall volume of job postings increased by more than 100% compared with the previous 12-month period.

The occupations that saw the fastest growth in absolute terms compared with pre-pandemic were as follows:

- Science, research, engineering and technology professionals (Programmers and software development professionals and IT business analysts saw the biggest growth in this category).

- Business, media & public service professionals (with biggest growth for management consultants, accountants, solicitors and project management professionals).

- Administrative (with largest growth in demand for business admin roles and book-keepers).

- Business, media & public service professionals (with notable growth for human resource specialists, marketing specialists, finance / investment analysts / advisers and sales executives / managers.

- Caring personal service (with the biggest growth in absolute terms for care workers / home carers, teaching assistants and nursing auxiliaries).

Skilled trade and elementary occupations are among those seeing the fastest percentage growth.

The fastest growing categories are:

Textiles, printing & other skilled trades – primarily driven by growth in demand for Chefs.

Skilled construction & building trades – driven by growth in demand across the range of construction trades.

Elementary trades – driven by an increase in postings for Elementary construction occupations.

Elementary administration & service – driven by particularly strong growth for Elementary storage occupations, Bar staff and Cleaners and domestics.

Administrative, digital and customer service roles are featured among those in greatest current demand in 2021/22.

“Baseline” skills in greatest demand, West Yorkshire, April 2021 to March 2022.

Specialised skills in greatest demand, West Yorkshire, April 2021 to March 2022.

Skills relating to use of Microsoft packages are in strong demand among recruiters.

Computing skill types in greatest demand, West Yorkshire, April 2021 to March 2022.

Looking beyond conventional digital specialists, digital skills are now central to a number of functional areas including marketing, engineering, design and analysis. Across this spectrum, social media, CRM and engineering design exhibit the strongest demand from employers.

Green Economy Skills

Green jobs and skills will in future be critical to the local economy as large-scale measures are implemented to meet West Yorkshire’s commitment to achieve a net zero carbon economy by 2038.

However, our interest extends beyond jobs that support the achievement of the UK's net zero emissions target to jobs that underpin other environmental goals, such as nature restoration, climate resilience and mitigation against climate risks.

It is difficult to assess current demand for “green” skills in the local labour market because job tasks and skill requirements that are relevant to the green economy are embedded in a wide range of occupations.

One of the ways in which we can assess current demand for green skills locally is by looking at the profile of vacancies posted online and drilling down on those that specify a requirement for “green” skills.

Strong increase in vacancies requiring green skills in 2020 and 2021.

Despite the growth over time, these green opportunities remain quite niche, at around 2% of total job postings in the 2021 calendar year. This figure for West Yorkshire is similar to the national average.

Most common green skill requirements, West Yorkshire

It is useful to illustrate the climate change requirement based on detailed information contained within job postings. A good example where this skill is required would be opportunities for project managers whose role is to lead on addressing climate change and sustainability issues within the organisation or on behalf of clients.

In the energy category skills in greatest demand include renewable energy, energy efficiency and energy management.

There are other skills which we have used as part of our definition such as electric vehicles at top left plus a range of skills that do not make the top of the rankings and do not therefore feature in the chart, such as green marketing, wind farm design and carbon offsets.

Project manager and civil engineer among occupations with biggest demand for green skills.

The ranking is dominated by STEM jobs, including engineers, scientists and technicians of various kinds; but it also contains project managers, sales managers, and skilled trades like electricians. A more detailed inspection of the data shows that the majority of the openings for project managers are in a construction context.

Civil engineer is ranked second in the analysis and this category includes specific roles like site engineers and geotechnical engineers, reflecting the environmental considerations that apply when sites are being developed.

Upskilling Needs

What kinds of staff skills do employers believe that they need to develop in order to meet business objectives? This is key to our understanding of skills demand in West Yorkshire.

Around two-thirds of employers expect future upskilling needs - they are most likely to highlight their managers as being affected.

Based on the Employer Skills Survey, almost two-thirds (64%) of employers in West Yorkshire expect that at least some of their staff will need to acquire new skills or knowledge in the coming 12 months. This is in line with the national average- also 64%.

Managers are the role most likely to be identified by employers as requiring future upskilling being highlighted by 41% of those with an upskilling need. This partly reflects the fact that managers are employed by virtually all organisations, whereas this is not the case for some other occupational groups which are represented in a smaller proportion of establishments.

Future trends in employment and replacement demands

Skills development often requires a considerable level of investment and a significant lead-in time. This means that it is important to take a forward-looking perspective on the demand for skills in order to anticipate future needs and to “future proof” investment decisions, so far as this is possible.

The Working Futures labour market model allows us to assess future sectoral and occupational employment prospects based on projections that are grounded in past patterns of performance and behaviour in the labour market.

There are a number of aspects to consider: net change in the level of employment by sector and occupation; replacement demand and the net recruitment requirement.

Net employment growth is expected to be concentrated in service-based activities.

The primary sources of net job growth in West Yorkshire over the next decade are forecast to be service-based in the form of Health and social work (+20,000 jobs), Professional services (+10,000) and Support services (+10,000).

Other sectors will also see net growth but at a smaller level in absolute terms, including Arts and entertainment (+3,000), Transport and storage (+3,000), Construction (+3,000), Information technology (+2,000) and Engineering (+1,000).

The fastest rates of growth are expected for Arts and entertainment and Health and social work, followed by Professional services and Support services.

The industries with the poorest prospects based on the forecasts are mainly drawn from the manufacturing and primary sectors of the economy. Much of the manufacturing sector, including food manufacturing (-5,000), is expected to see a marked net decline in jobs, largely continuing longer-term trends. Nonetheless, these sectors will still have a positive recruitment requirement arising out of replacement demands and will see growth in higher skilled jobs although these will be offset by reductions in lower-skilled and routine posts.

Higher skilled occupations are expected to grow much faster than the overall rate.

Even though there is uncertainty about the future growth trajectory of the UK economy and the sectoral pattern of change within the economy, it is worth noting that established trends in occupational employment have proven to be largely resilient in recent years, even in the face of the last recession.

Taken together, these three occupational groups have a combined growth rate of 11% (growth of 65,000 in absolute terms), around five times the average rate.

Middle skilled occupations are projected to see continued net decline.

The most pronounced net decreases are expected for Secretarial roles (projected net decline of -45%), Textiles, printing and other skilled trades (-22%) and Skilled metal, electrical and electronic trades (-16%). Employment in Administrative occupations, the largest middle-skilled occupational area by far is projected to decline less rapidly with an employment decrease of -5%, whilst employment in Skilled construction and building trades is expected to remain largely static (decline of -2%).

By 2027 employment in Administrative and Secretarial occupations is expected to be 25,000 lower than its 2017 level and to be 17,000 lower in skilled trades.

There is expected to be a net decline of 13,000 (-24%) in Process, plant and machine operative jobs (semi-skilled blue collar occupations). Employment for Transport & mobile machine drivers and operatives is expected to increase by 22,000 (3%), however.

Caring personal service jobs are expected to see largest growth in absolute terms.

Caring personal services is expected to see the largest growth in absolute terms of any of the occupational sub-major groups of around 24,000 net additional jobs, a growth rate of 19%.

Employment in Elementary administration and service roles is projected to remain broadly static (-1%). Elementary trades employment is projected to fall by 2%.

Growth in Customer service jobs of 6,000 (+16%) is projected to be offset by a net decline in employment of 9,000 (-9%) in Sales occupations.

Over the next decade replacement demands are expected to generate 19 times as many job openings as net growth.

In absolute terms this equates to around 27,000 job openings resulting from net growth and 515,000 openings arising from replacement needs, giving a total number of job openings (net requirement) of approximately 542,000.

Recruitment needs will be greatest for higher skilled occupations and caring occupations.

Almost all higher skilled occupational sub-major groups are expected to see strong demand as a result of this effect and especially Corporate managers (54,000), Business and public service associate professionals (45,000) and Teaching professionals (30,000).

Replacement demands mean that job openings are expected in all broad occupational groups including those that are projected to see net decline.

Automation

Technology is one of the main drivers of change in the profile of occupational employment and many commentators have expressed concerns about the future potential for widespread displacement of workers by technologies like robotics and artificial intelligence.

At the current time, as the economy recovers from the effects of the pandemic, there is strong demand for workers across the occupational spectrum. However, analysis of the susceptibility of occupations to automation suggests that some that are presently in strong demand could be susceptible to change in the longer term, although predictions of this kind are inevitably subject to a high degree of uncertainty.

Lower level, routine or physical skills have the greatest exposure to automation.

The overall pattern is one in which occupations comprised mainly of lower level, routine or physical skills have the highest exposure to new technology, whilst those with the lowest exposure are those requiring more analytical and interpersonal skills.

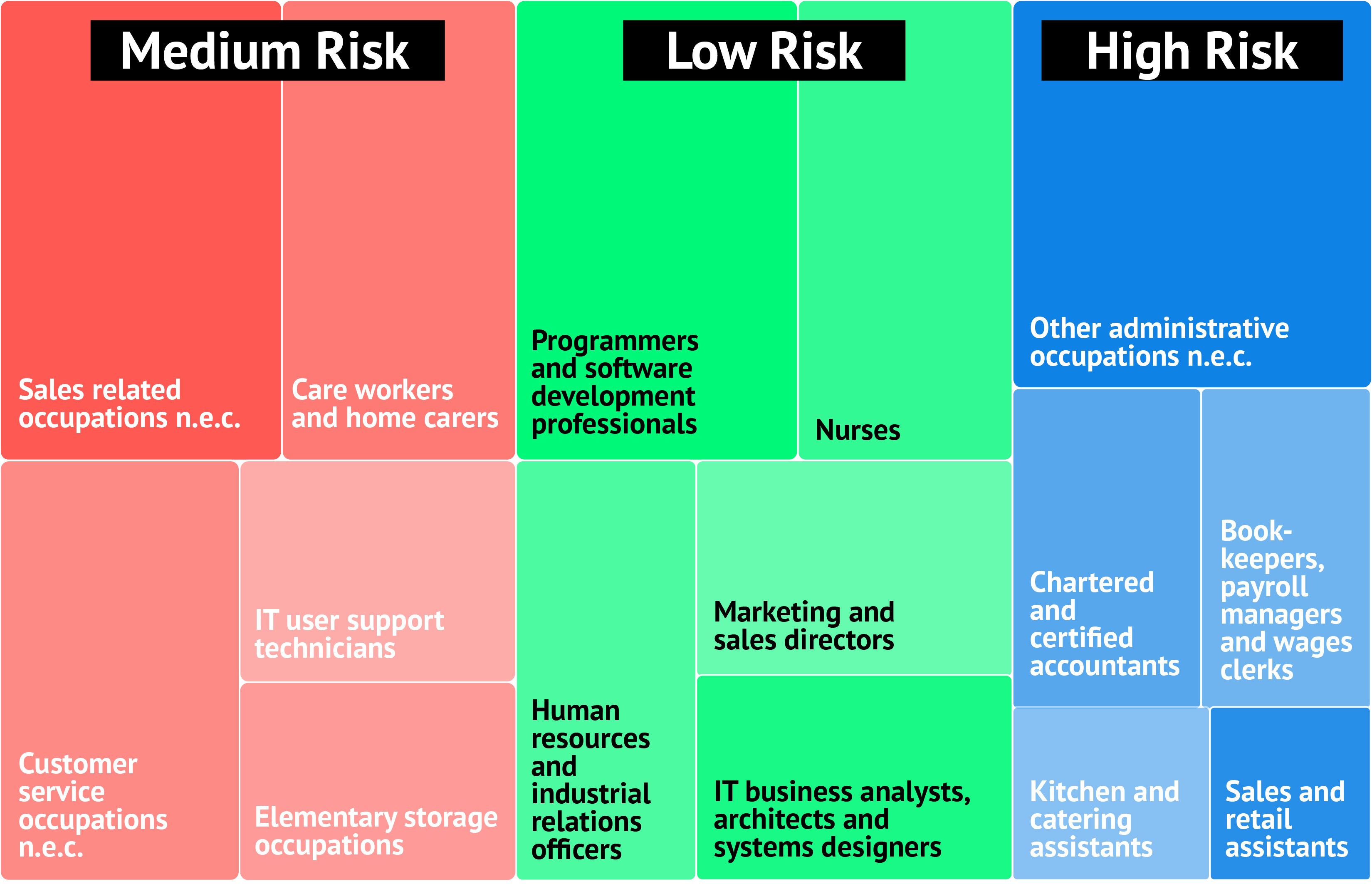

To give a flavour of the detailed occupational areas according to their risk of automation and their current levels of recruitment demand, the following figure sets out current volumes of job postings for occupational unit groups that are classified as high risk by Burning Glass (data). For each risk category, the most in-demand occupations are featured.

It shows a variety of occupations at high risk, most notably administrative occupations (Other administrative occupations nec includes general business admin-type roles), finance roles including accountants at professional level and clerical roles linked to financial operations, plus elementary service roles in the form of Kitchen and catering assistants, together with Sales and retail assistants. The high-risk occupations with the greatest current demand are therefore at a variety of levels, from the highly paid (accountants), to intermediate occupations (administrative) to lower-paid (kitchen and catering assistants).

The previous analysis of patterns of employment change shows that administrative roles in particular have seen recent net growth in employment as well as being currently in strong demand in terms of vacancies. This is in contrast to secretarial roles (also high risk with regard to automation) which have seen a steady decline in employment, largely due to substitution of human tasks by technology. This illustrates the uncertainty attached to automation forecasts.

The availability of the right number of people with the right skills is critical to West Yorkshire’s ambition to achieve inclusive growth. Skills play a key role in driving productivity and competitiveness within firms, and they underpin the employability and earning potential of individuals. The following section examines the overall level and profile of labour supply in West Yorkshire as well as the key characteristics of the “skills pipeline”, with regard to the various elements of the education system as well as employer investment in workforce development.

Demographic Trends

West Yorkshire’s working age population is growing but less quickly than nationally.

West Yorkshire has a total population of 2,345,000 with 1,473,000 (63%) people of working age (16-64). The working age population of the area grew by 2% over the course of the last decade (2011 – 2020), less quickly than the national average, which saw an expansion of 3%.

Bradford and Leeds have relatively young populations.

An increase in the number of young people is projected for the next decade.

The local working age population is projected to grow by 2% over this period from 2018 (base year) to 2030, compared with growth of 3% nationally. In absolute terms this is an increase of 35,000 in the number of people aged 16-64. Much of this growth is driven by an increase in the number of young people aged 16-24 of 12% or 34,000.

Qualification Profile

One of the key challenges facing West Yorkshire is a deficit in its skills base relative to other parts of the UK. This is closely associated with its underperformance on productivity and innovation. West Yorkshire has seen improvement in its qualification profile in recent years but a significant gap remains.

West Yorkshire has fewer people qualified at Level 4 and above than nationally, although the gap has narrowed.

The proportion of working age people in West Yorkshire with no qualifications continued to fall from 9% in 2019 to 8% in 2020, still above the national average of 6%.

Attainment at level 2 is often regarded as the threshold for basic employability. More than a fifth (22%) of working age people are qualified below this level in West Yorkshire, compared with the national average of 19%.

Qualification attainment of young people

The qualification profile of West Yorkshire’s population is relatively poor, with a smaller proportion of people qualified at level 4 and above than nationally and a greater proportion with no qualifications or qualified below level 2.

The attainment of young people at level 2 and level 3 contributes to West Yorkshire’s qualification deficit.

Young people in West Yorkshire are less likely to have achieved a level 2 qualification by the age of 19 than their national counterparts. The proportion is 77%, 4 points lower than the England average. Two districts (Calderdale and Kirklees) match the national average but in Bradford only 73% achieve level 2 by the age of 19, 8 points behind the national average, whilst Leeds is around 5 points behind on 76%.

Pupils eligible for free school meals are subject to a big attainment gap at age 19.

In West Yorkshire the attainment gap between those eligible for free school meals and those not is 22 percentage points. Attainment is also poorer in West Yorkshire than nationally for both free school pupils and those not eligible, with a gap of 3 points for both groups.

Apprenticeships

Apprenticeships are a key means for employers to address their own specific needs. They can mould the apprentice to suit their job roles and meet skills gaps, particularly in areas of skills shortages, as well as providing workers with a sustainable career pathway.

Apprenticeship take-up fell by more than a fifth during the academic year.

There were 14,528 apprenticeship starts in West Yorkshire in the course of the 2020/21 academic year.

During 2020/21, there were just under 6,500 apprenticeship achievements in West Yorkshire, a fall of 22% on 2018/19.

Starts fell for under-19s during the academic year.

Starts among the under-19s fell by 13% in 2020/21 – whereas they grew among 19-24 year olds (+4%) and those aged 25+ (+3%). Under-19 starts are now almost one-third (31%) lower than in 2018/19 compared with an overall fall in starts of 23%.

Higher apprenticeships starts grew strongly.

During 2020/21, starts on intermediate apprenticeships accounted for 27% of total starts (down from 32% in the previous academic year and from 37% in 2018/19), advanced apprenticeship starts contributed 43% (similar to the previous year) and higher apprenticeships 30% (up from 23% in 2019/20 and only 19% in 2018/19).

Wakefield saw a significant fall in apprenticeship starts during the academic year.

Three out of five local authorities saw growth in starts during the year, ranging from a 2% increase in Leeds to 4% in both Bradford and Kirklees. However, this was offset by a small reduction in Calderdale (-2%) but a much larger one (-15%) in Wakefield.

Apprenticeships are increasingly being used to develop existing staff.

The core purpose of apprenticeships is to provide an entry route into a sustainable career. Increasingly, however, apprenticeships are being used by employers to train their existing staff, a trend that has been accelerated by the introduction of the apprenticeship levy.

Providers

Private-sector public funded providers delivered 8,774 apprenticeship starts in West Yorkshire in 2020/21, a majority (60%) of total starts. This figure represents a slight increase in starts of 3% on the previous academic year.

General FE colleges contributed 3,759 starts, 26% of the total – and a decrease in starts of 18% on the previous year.

Subject area

Performance was extremely mixed in terms of starts by subject area.

There were increases in starts for six of 12 subjects, most notably Health, Public Services and Care (+940, +25%), Information and Communication Technology (+182, +28%) but also Business, Administration and Law (+52, +28%) and Arts, Media and Publishing (+44, +142%).

On the other hand, there were big declines for several subject areas, including Engineering and Manufacturing Technologies (-989, -40%), Construction, Planning and the Built Environment (-257, -20%) and Leisure, Travel and Tourism (-57, -37%).

Higher Apprenticeships

As higher skilled jobs increasingly dominate the employment scene, higher apprenticeships gain greater significance particularly for occupations in which exposure to the workplace is key. The number of higher apprenticeship starts in West Yorkshire increased by 27% in 2020/21, offsetting decline for the other levels and giving a total of around higher 4,300 starts during the academic year.

Apprenticeships at levels 4, 6 and 7 grew strongly in terms of starts, by 46%, 35% and 32% respectively; with starts at level 5 growing by 6%.

Disadvantaged pupils are less likely to enter an apprenticeship in all parts of West Yorkshire.

Across all council areas of West Yorkshire disadvantaged pupils are less likely to enter an apprenticeship than other pupils on the completion of Key Stage 4. Although West Yorkshire has an overall apprenticeship entry rate that is above the national average, only 3% of pupils eligible for free school meals enter an apprenticeship compared with 5% of pupils who are not eligible. The gap is particularly wide for pupils in Leeds and Wakefield.

There is acute gender segregation within apprenticeships and ethnic minority groups are under-represented, particularly in young people who undertake apprenticeships.

Adult Education

Looking beyond apprenticeships there is also significant public investment in further education, including Education and Training and Community Learning provision.

The impact of the pandemic continued to be felt in 2020/21 academic year.

The level of participation on Education and Training courses fell by 1,240 (-3%) in 2020/21 following a 16% fall in the previous year. Community Learning was hardest hit with a fall in participation of 5,960 (-38%) following a 25% decline in 2019/20.

The extent of the decline in participation in 2020/21 varied by local authority area. Wakefield saw the largest fall in Education and Training participation of 8% (-430), while in contrast Leeds saw growth of 3% (+380).

The performance of different subject areas presented a mixed picture during 2020/21.

Preparation for Life and Work is the largest subject area in enrolment terms within this programme strand. It saw a further fall in enrolments in 2020/21 of -1,260 (-4%) but this was a less pronounced decline than in 2019/20.

Other subjects which saw decline, include:

- Information and Communication Technology: -1,434 (-36%), with a big fall in ICT User enrolments.

- Retail and Commercial Enterprise: -529 (-11%), with big falls in Hospitality and Catering, Retailing and Wholesaling and Warehousing and Distribution.

- In contrast, some subject areas saw substantial growth in 2020/21, most notably:

- Health, Public Services and Care: +2,144 (+17%), with growth concentrated in Health and Social Care.

- Business, Administration and Law: +606 (+9%), with strong growth in Administration enrolments.

- Engineering and Manufacturing Technologies: +304 (+27%).

- Health, public services and care is the only subject area with a higher level of enrolments in 2020/21 than in 2018/19 (pre-pandemic).

Higher Education

It has already been noted that West Yorkshire has a deficit of higher-level qualifications among its working age population; however, it has a large and diverse higher education sector.

West Yorkshire enjoys a net inflow of HE students.

With around 95,000 students enrolled at its seven institutions during the 2019/20 academic year, West Yorkshire has one of the largest higher education sectors outside London.

Just over a third (37%) of students enrolled at West Yorkshire institutions are from West Yorkshire.

The subject profile of qualifiers has also remained broadly stable over time with Computer Science accounting for 3% of the total (around 700 per annum), Engineering & technology for 5% (c.1,200) and Architecture, building & planning around 1-2% (400).

West Yorkshire provision has a distinctive subject profile

The subject profile of qualifiers from West Yorkshire’s HEIs is somewhat different to the national picture, particularly with reference to subjects in key skill shortage areas. Architecture, building and planning and Computing both account for smaller proportions of total qualifiers than is the case nationally, although Engineering and technology contributes a slightly larger proportion. Conversely, West Yorkshire is above average in terms of Subjects allied to medicine (a category which includes nursing), Biological and sports sciences and particularly in Design, and creative and performing arts. More broadly, science and technology subjects account for a similar proportion of total qualifiers as nationally, at 42% and 43% respectively.

Around a quarter of qualifiers from West Yorkshire institutions are in employment in the region 15 months later.

For some technical subjects, West Yorkshire retention rates are relatively low; for example, 13% for Agriculture, 15% for Mathematical Sciences and 19% for both Physical Sciences and Engineering and technology. Education is at the top of the ranking, with a rate of 34%, followed by Law and Subjects allied to medicine.

Disadvantaged pupils in West Yorkshire are less likely to enter higher education with no sign of sustained reduction in the gap.

West Yorkshire’s overall progression rate into higher education, at 41%, is two percentage points below the national average. It is also below the average for free school meal (FSM) and non-free school meal pupils.

Performance on entry rates varies by local authority. Wakefield and Leeds have the lowest overall entry rates, which are 7 and 4 points below the national average respectively. Bradford is two points below but Calderdale and Kirklees each outperform the national average by 2 points.

Wakefield and Leeds also under-perform against the national average with regard to FSM pupils, by 11 points and 7 points respectively. The remaining three local authorities outperform the national average, by 4 percentage points in the case of Calderdale.

Skill mismatches reflect an imbalance between supply and demand in the labour market, between the skills available and the skills needed by employers and the wider economy.

This inability to obtain the skills that are needed is a key barrier to business growth and improved productivity for firms. In some cases, individuals invest in skills that have limited economic value in terms of employer demand and this represents a missed opportunity for the individual and a constraint on their career potential.

Skills mismatches are often short term, as the operation of the market leads to an increase in the supply of people with the necessary skills, but in some cases, they are acute and persistent, with significant implications for business performance. This kind of market failure presents a policy priority but also offers an opportunity for individuals considering their career options to target areas of unmet demand.

Worker Shortages

The re-opening of the economy has led to a pronounced tightening of the labour market as the number of vacancies has increased to record levels nationally and the number of people actively seeking and available for work has fallen. This situation is reflected in wide worker shortages reported by businesses. Around 13% of all businesses indicate that they are experiencing shortages.

At national level, survey data shows that sectors that were most affected by lockdown during the pandemic are more likely to have worker shortages now. Most notably, the hospitality sector (Accommodation and food services) faces an incidence of shortages that is more than twice that of the overall economy.

Skills Shortages

Skill shortages occur when employers find it hard to fill their vacancies because the available candidates lack the necessary skills, qualifications and experience to do the job.

The Department for Education’s Employer Skills Survey provides information on the number of vacancies and skill shortage vacancies that employers have at a single point in time. Skill shortages do not occur in large numbers and are not widespread. They tend to be concentrated in particular industry sectors and occupations but where they do exist they can be acute and persistent, acting as a significant constraint on business growth and performance.

Around a quarter of all vacancies are skill shortage vacancies in West Yorkshire.

Data are also available at Local Education Authority level and these suggest that Wakefield has the highest prevalence of shortages (41%), whilst Bradford and Calderdale are similar to the West Yorkshire average and Kirklees and Leeds are both somewhat below the average.

The occupational pattern of shortages provides an insight into the particular types of jobs that are most affected by a lack of candidates with the skills needed by employers.

Shortages are most prevalent in skilled trades.

The latest data show shortages are most acute for jobs that require higher level and intermediate technical skills, specifically associate professional and technical, professional and skilled trades occupations. These occupations often require skills that take an extended period to develop and in some cases depend on training and development in a workplace setting.

With regard to the skills that employers found difficult to obtain from applicants, specialist, occupation-specific skills and knowledge required to perform the role are the type most commonly highlighted (for 59% of shortage vacancies). A deficit of technical or practical skills of some kind is highlighted by employers with reference to more than 80% of skill shortage vacancies. However, other skills including customer handling, team-working and time management were also highlighted.

The detailed occupations with the most acute shortages in Yorkshire and the Humber include health, engineering and digital professionals plus a range of skilled trades.

Skills Gaps

Skills gaps are another form of skills mismatch and come about when existing employees within an organisation are not fully proficient in their job and are not able to make the required contribution to the achievement of business or public service objectives. The pattern of skills gaps provides a useful indication of employers’ needs in terms of workforce development.

15% of employers are affected by skills gaps, with administrative and sales and customer service staff most susceptible to gaps

The prevalence of skills gaps (in terms of the volume of gaps presented as a proportion of total employment) is broadly similar across the five local authorities of West Yorkshire, although it is somewhat higher in Calderdale and slightly lower in Kirklees and Wakefield. The proportion of employers who report having a skills gap is highest in Wakefield at 19% (suggesting that gaps are thinly spread across organisations in Wakefield) with the remaining local authorities standing at between 14% and 15%.

Three sectors of the local economy have the highest prevalence of skills gaps: Business services, Education and Hotels and restaurants. The first of these sectors also has by far the highest volume of gaps in absolute terms. The Wholesale and retail sector has a high volume of gaps but their prevalence relative to employment is modest. Together these four sectors contribute more than 60% of total skills gaps. Construction also has an above average prevalence of gaps.

Many skills gaps are due to a deficit of practical skills among workers, including job-specific skills and operational skills, such as knowledge of the organisation’s products and services. Complex analytical skills, such as problem solving, plus digital skills at a variety of levels, as well as basic skills (functional literacy and numeracy) are also in deficit for many staff.

A lack of the required “soft” skills is more common across the workforce, including “self-management” skills such as time management and managing own feelings, plus team working and persuading / influencing others. Management, whether it be aspects of self-management or leading / managing staff within the organisation, is a key element of skills gaps, together with sales and customer handling skills.

For managers with skills gaps the main types of skill that need to be improved include core management skills, complex problem-solving skills, as well as operational skills.

Many skills gaps are short term and associated with high rates of staff turnover, particularly in sectors like hospitality, in the sense that the workers are new to the role or their training is not yet complete.

Skills gaps could worsen in future.

According to one model, by 2030, 7 million additional workers could be underskilled for their job requirements, equivalent to about 20% of the labour force.

This reflects new skills mismatch opening up within existing jobs and from transitioning to new occupations. The main areas of deficit are forecast to be ‘workplace skills’ rather than in ‘qualifications’ and ‘knowledge’. Reflecting the current pattern of skills gaps, underskilling is expected to be greatest in respect of basic digital skills (although the basic requirements of 2030 are likely to look advanced compared with today’s needs), management skills, STEM workplace skills and teaching and training skills.

Essential digital skills

Digital skills are becoming increasingly essential to daily life as well as being key requirements for the workplace.

To have the foundations of Essential Digital Skills (EDS), is to be able to access the Internet by yourself. A number of things must be true for this to be the case, including an individual being able to use a device, connect to a Wi-Fi network and create and update passwords. However, many adults lack these skills at a basic foundation level and can therefore be considered to be digitally excluded.

Certain population groups more likely to be digitally excluded, most notably older people, people who are less qualified, those with a sensory impairment, those on a low income, those who are not working and people living alone.

Demand and supply for high skilled workers

Growth in higher-skilled jobs continues to outpace that in the number of higher qualified people.

As of the period from January to December 2020 the number of higher qualified workers stood at 487,000 whilst the number working in high skilled occupations stood at 541,000.

There was a sharp increase in people qualified to Level 4+ and in the number of people in higher skilled employment in 2020, in spite of the impact of the pandemic.